First Colombian Film Industry Bulletin

A project designed by Fedesarrollo for Proimágenes

SPECIAL REPORT

Colombia’s Film Market: Vigorous and Promising Growth

Download Special Report in Excel.

1. EVOLUTION OF COLOMBIAN FILM MARKET

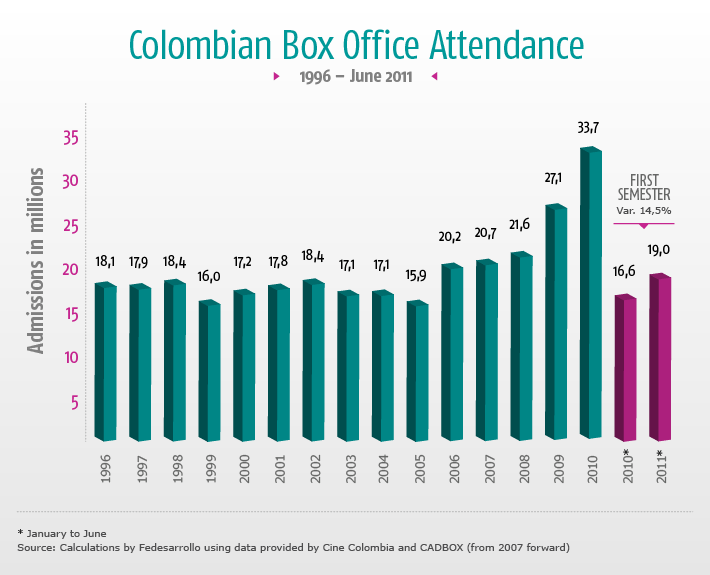

- Between 1996 and 2005, average annual film attendance in Colombia was 17.4 million spectators.

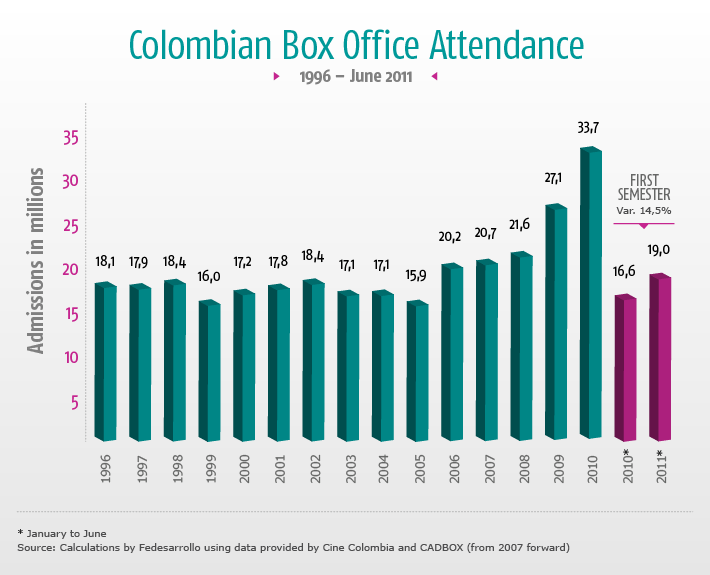

- The Colombian film market began its sustained growth in 2006. Attendance in Colombia has doubled in the past six years, from 16 million spectators in 2005 to 33.7 million in 2010.

- The trend continues; in the first half of 2011, attendance increased by 14.5% compared to the same period the previous year.

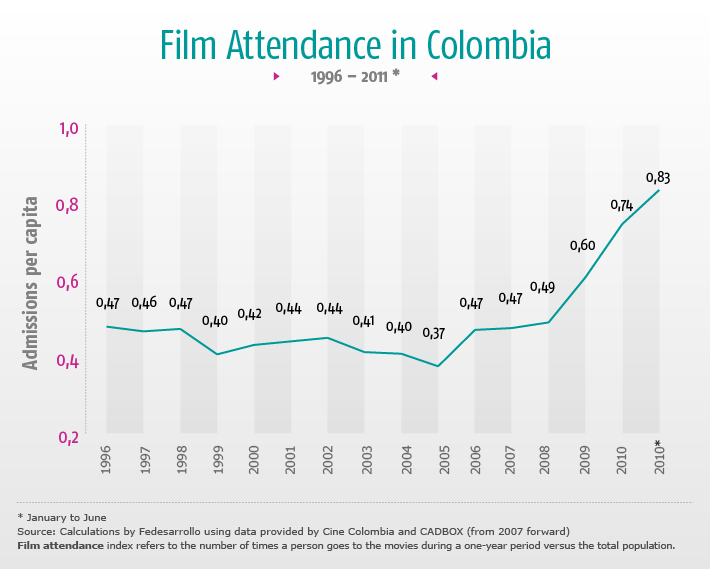

- Attendance was poor during the 1990s (percentage of spectators in total population), reaching only 0.4 in 1999.

- The rise in number of spectators in Colombia in recent years increased the attendance rates, doubling them over five years, from 0.37 spectators per inhabitant in 2005 to 0.74 in 2010.

- In the first semester of 2011, the attendance rate continued to grow and has now reached 0.83 spectators per inhabitant.

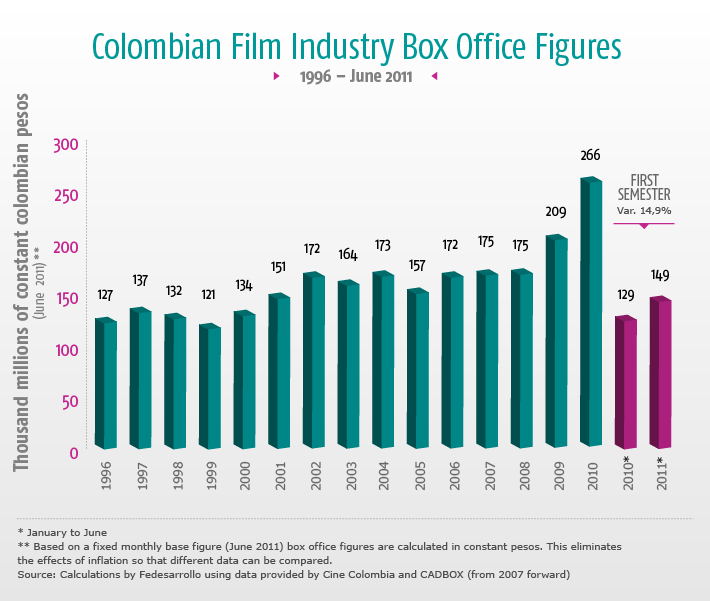

- At the end of the 1990s, the average box office total was 129.4 billion constant pesos (using June 2011 as base figure).

- In recent years, positive results in the Colombian film industry are also visible in box office figures. In the last six years, this box office total has risen by 60%, from 157 billion pesos to nearly 270 billion pesos in 2010 (constant prices based on June 2011).

- This trend continues. From January to June 2011 total box office grew by 15% over the same period in the previous year.

- From 1996 to 1999, an average of 258 national and foreign films were released for an average of approximately five films per week.

- From 2000 to 2010, the number of annual releases averaged 189 films, less than four releases weekly.

|

2. EVOLUTION OF COLOMBIAN FILM INDUSTRY

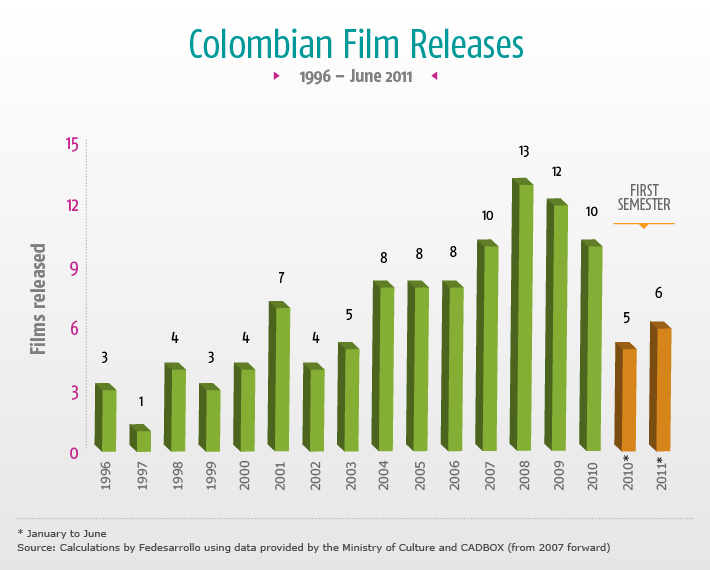

- Prior to the Film Law of 2003, an average three national films were released annually.

- The number of releases increased noticeably after the Film Law went into effect. In 2008, a historic high of 13 national releases was achieved.

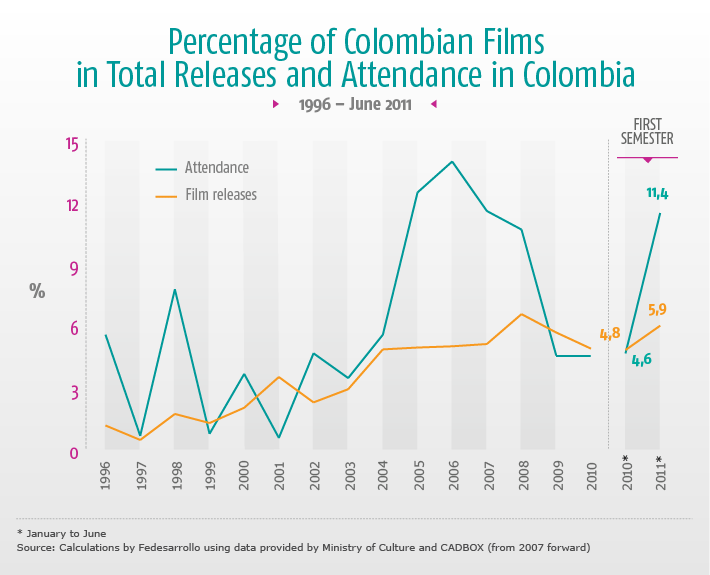

- In recent years, attendance at Colombian films has increased substantially over figures recorded during the previous decade.

- In spite of the above, attendance at Colombian films varies from one year to the next, a common phenomonon among small, developing industries.

- 2011 has been an excellent year for attendance at Colombian films. During the first semester of the year, attendance has exceeded the number of spectators annually in both 2009 and 2010.

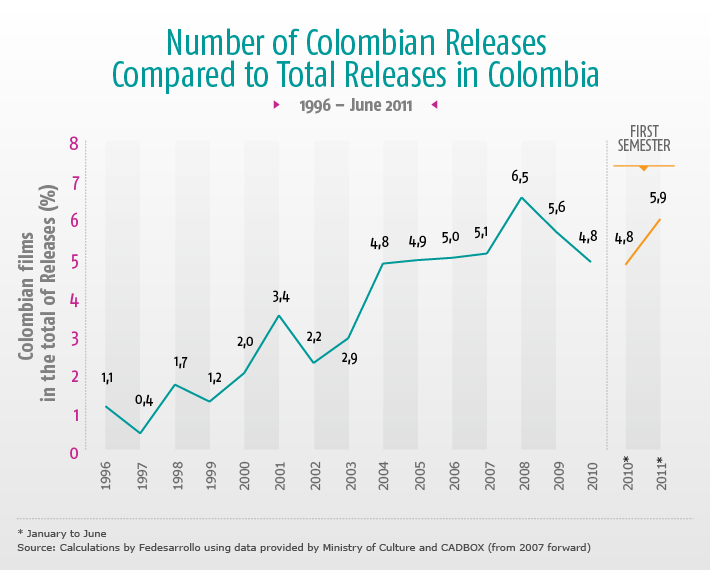

- Prior to the Film Law (Law 814 of 2003), Colombian film productions represented an average of merely 1.9% of the total film releases every year.

- Recently, national film releases are responsible for a greater portion of total releases. In the past seven years, 5% of all films released have been Colombian.

- So far in 2011, Colombian films are responsible for 6% of total releases.

- During the 1990s, 1996 and 1998 stand out as years in which the Colombian films figured highest in attendance records.

- After the Film Law went into effect, national film productions have been responsible for a good portion of total attendance figures. Attendance at Colombian films has fluctuated around 5.3% of the country's total film attendance.

- In the first six months of 2011, Colombian films brought in more than 11% of total spectators.

- The percentage of Colombian films in total attendance figures is greater than the percentage of these films in total releases, which shows that on an average Colombian films attract more spectators than other releases.

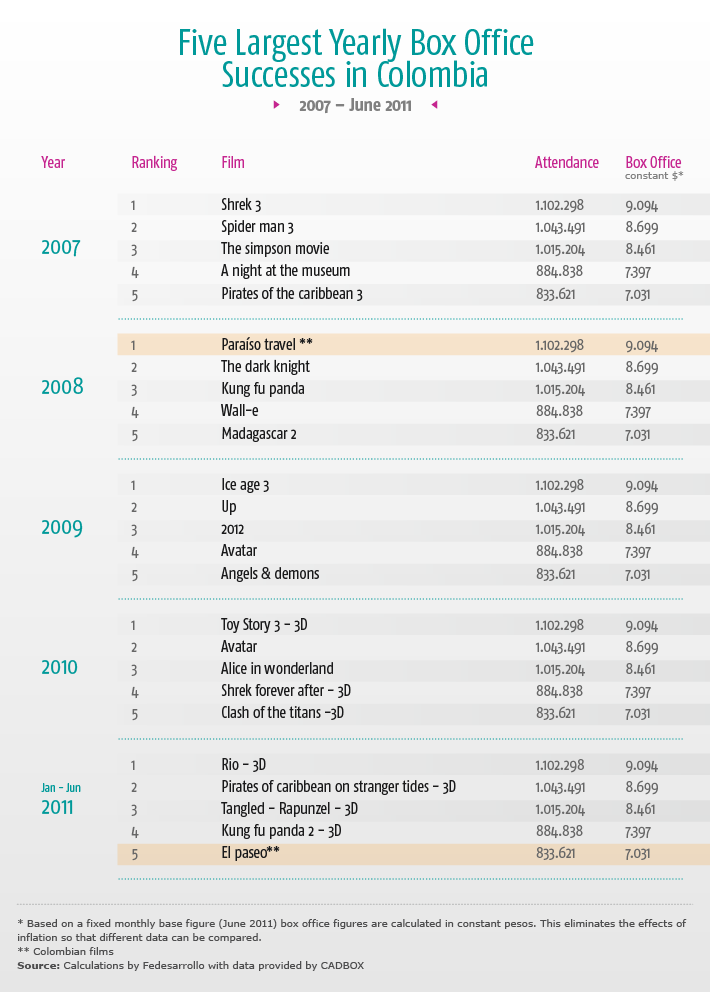

- Between 2007 and the first semester of 2011, in real terms, the biggest box office successes have been familiar stories such as Toy Story 3 (2010), Avatar (2010) Ice Age 3 (2009) and Rio (2011).

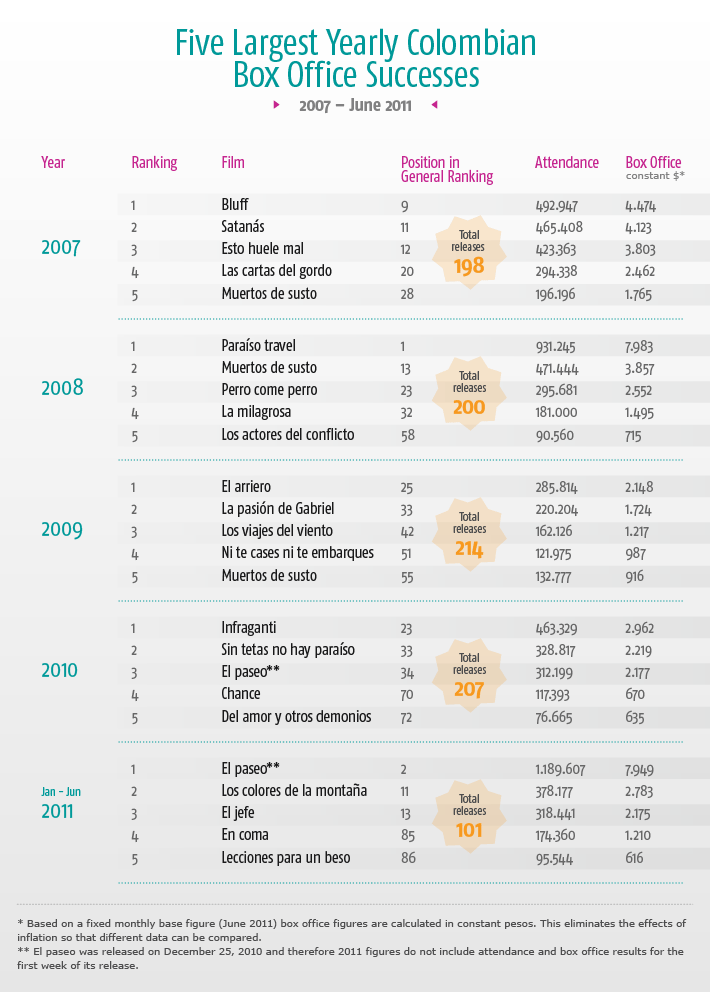

- Paraíso travel in 2008 and El paseo in 2011 were the only Colombian films to make it into the top five box office successes in the years they were released.

- Since 2007, Paraíso travel (2008) and El paseo (2011 to date) were the biggest box office successes among Colombian films bringing in $7.983 million and $7.949 million pesos, respectively (constant prices based on June 2011).

|

3. INTERNATIONAL COMPARISON

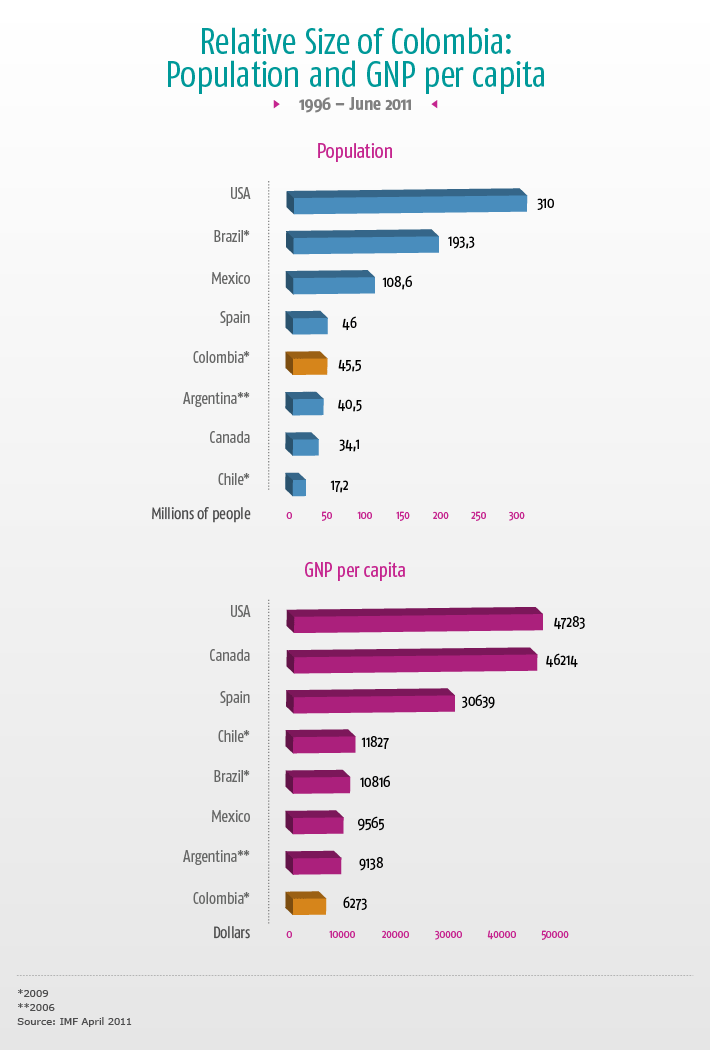

- Colombia, with 45.5 million inhabitants, has the third largest population in Latin America after Brazil (193.3 million) and Mexico (108.6 million).

- Chile and Brazil head the list of Latin American countries with the largest per capita income with USD $11,828 and USD $10,816, respectively. The GNP per capita in Colombia is USD $6,273.

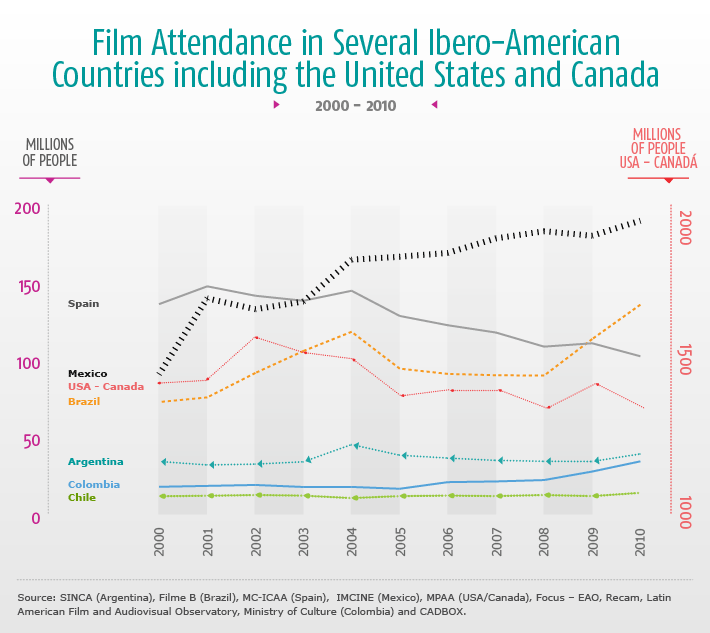

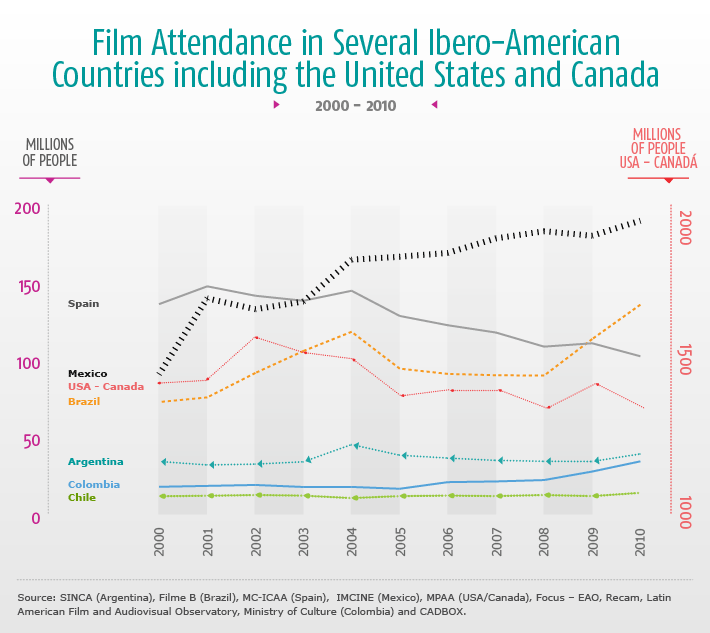

- The number of moviegoers in countries such as the US and Spain has dropped in recent years. This decline meant an annual loss of 230 million viewers in the US from 2002 to 2010.

- Over the last decade, attendance in certain Latin American countries such as Mexico and Brazil has risen significantly. During these ten years, the number of viewers in Mexico increased by 100 million viewers and by 67 million in Brazil.

- In the past five years, attendance in countries such as Argentina, Colombia, Peru and Chile doubled. However, there is still a lot of room for growth in these countries.

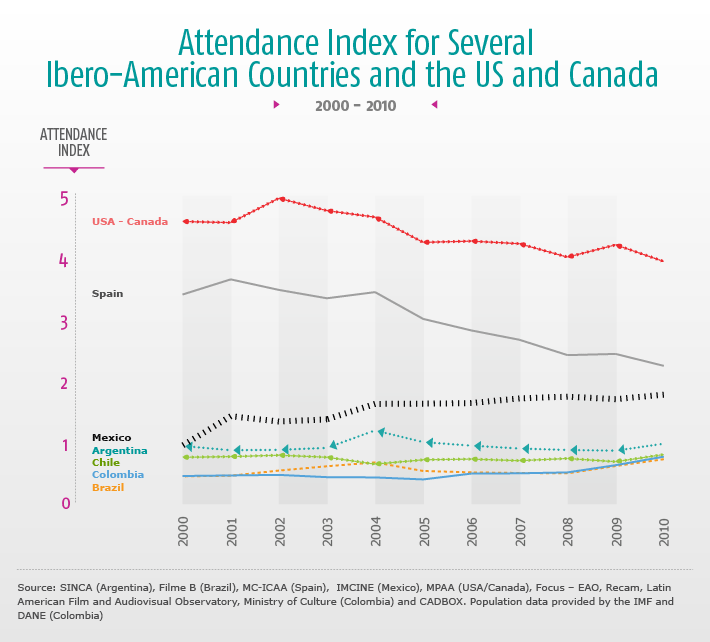

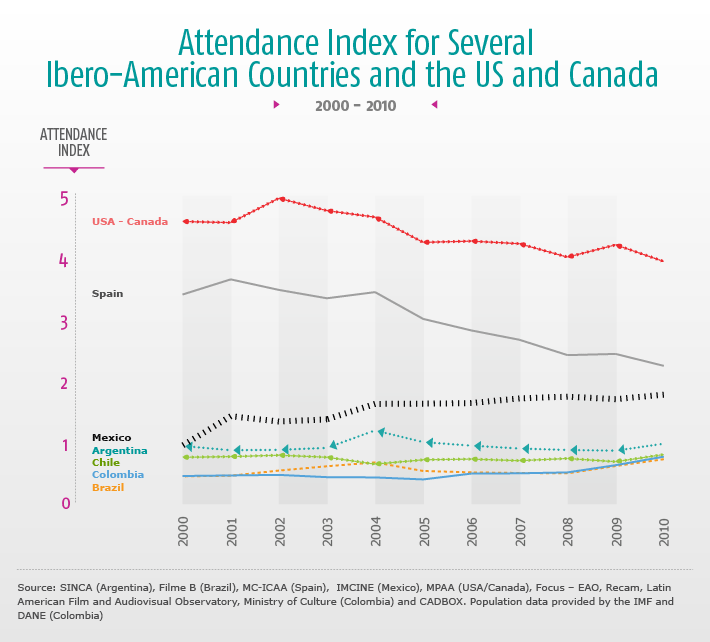

- While movie attendance (number of admissions per capita) has stagnated in developed markets, in Latin America it is on the rise.

- The drop in admissions in developed markets such as the US and Spain is even greater when seen in terms of population (attendance index) rather than in absolute terms.

- Mexico has the highest Latin American attendance index, with close to two admissions annually per capita.

- Colombia stands out among medium-size Latin American countries due to the notable increase in attendance but has yet to reach the one attendance per year per capita mark.

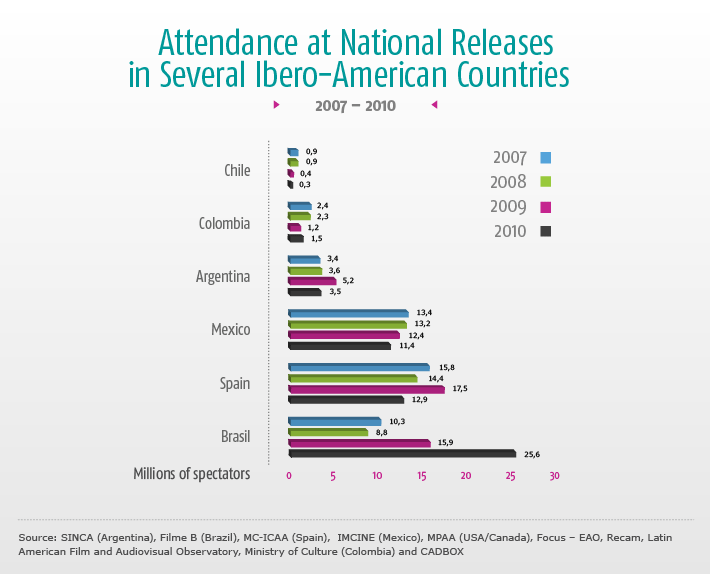

- Spain and Argentina lead in production of Ibero-American films. In 2009, Spain released 137 national productions and in Argentina in 2010, 84 national films were released.

- Colombian film productions rank among the region's second group, behind large producers (Argentina, Brazil and Mexico) and producing on a level with Chile, where a total of 15 films were released in 2009.

- The most heavily attended national releases in Ibero-American nations are in Brazil, Spain and Mexico (the three most heavily populated countries).

- Colombia falls into the region's second group, with less attendance than in Argentina and more than in Chile.

- The gap between the region's largest nations and Colombia narrows when one analyzes national film attendance based on relative population.

- Colombia is third in the Latin American attendance index after Mexico.

- Although attendance figures for 2011 for all of Latin America are as yet unknown, Colombia is sure to stand out given its high attendance at national releases.

|

4. GROWTH INDICATORS FOR COLOMBIAN FILM INDUSTRY

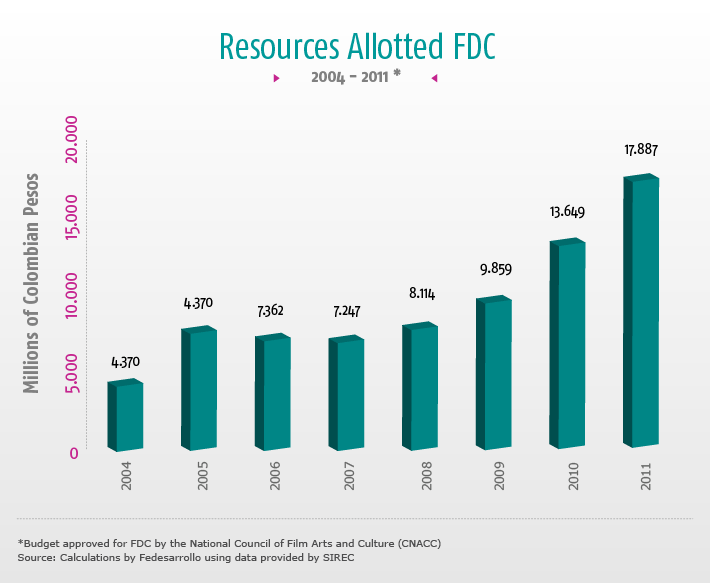

- Law 814 of 2003 (known as the Film Law) created incentives for the Colombian film industry such as a Film Development Fund (FDC) and a number of tax incentives.

- The FDC is maintained by parafiscal contributions from exhibitors, distributors and producers of Colombian films. These parafiscal contributions have made it possible to collect nearly 65 billion pesos between 2003 and the first semester of 2011.

- The FDC distributes these resources through call-for-entries and automatic and other stimuli.

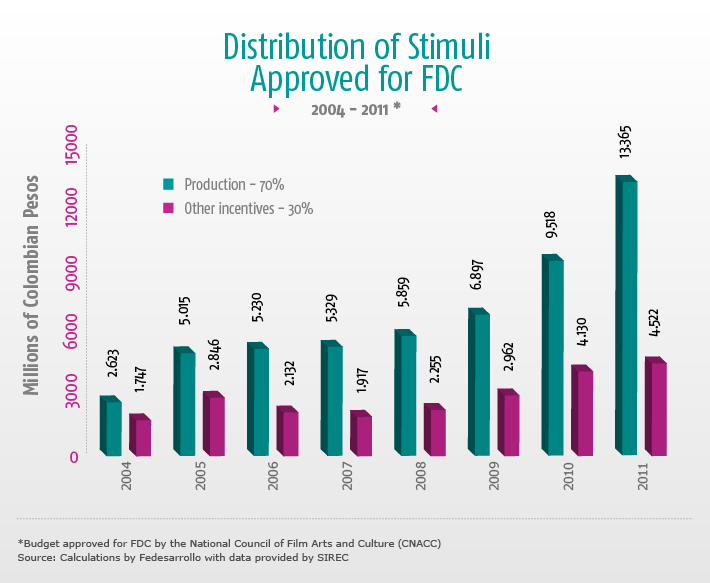

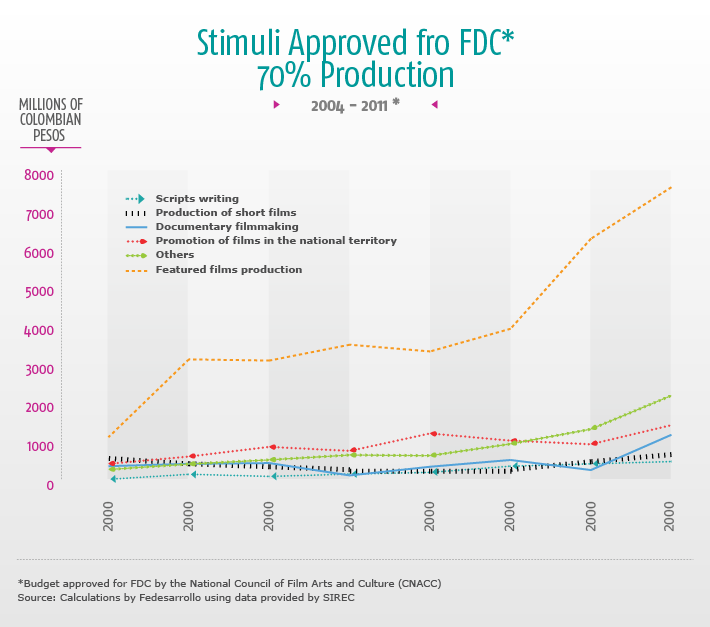

- The Law assigns 70% of FDC resources to the creation, production, coproduction and directing of feature-length films, short films and documentaries.

- The remaining 30% of FDC resources support complementary actions taken to promote the filmmaking industry, including preservation of the nation's film archives, training programs, an anti-piracy campaign, and international promotion.

- The FDC's 2011 budget approved by the National Coucil of Film Arts and Culture (CNACC) totals 17.9 million pesos, of which 13.4 million were approved for production and 4.5 million for other stimuli.

- The majority of the 70% of FDC resources earmarked for film production go to feature film production. A total of 7.55 million pesos were approved in 2011 for feature film production.

- In 2011, the FDC will disperse 2.25 millions pesos to stimulate production of documentaries, short films and the writing of screenplays.

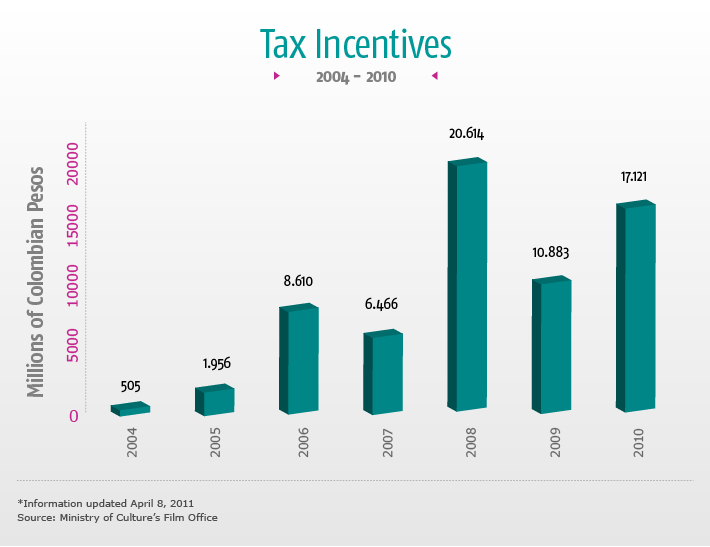

- With Law 814 of 2003, the Colombian government also began offering incentives to those who invest in national film production.

- The Film Law is an incentive for individuals and private enterprise to invest in and donate resources to national film productions. This tax incentive decreases the tax base of investors or donors by 125% of the amount invested or donated.

- Since 2004, a total of 66.155 millions pesos in incentives have been granted to investors, benefitting 80 different film projects.

|

|

SPECIAL REPORT

The cinema market in Colombia: a promising high growth

Colombia's film industry has experienced a surprisingly dynamic surge recently, in contrast with events in developed nations where the film market has shrunk substantially in past years. Although the recent vitality in Colombia is paralleled in other Latin American countries, the recent growth in Colombia has been more vigorous and allows for substantial optimism with regard to the industry's future in our country.

This Special Report illustrates the current dynamic activity in the Colombian film industry in recent years and compares it to situations in other countries. It also evaluates a number of plausible hypotheses regarding the factors responsible for this positive trend.

Graphic 1 shows how in 2006 film attendance in Colombia began a period of sustained growth. This dynamic has been so significant that in the past ten years film attendance in the country has doubled – up from approximately 16 million spectators in 2005 to 33.7 million in 2010. So far this year, the upward trend continues. In the first semester of 2011, attendance grew by 14.5% over the same period the year before.

Graphic 1:

This positive trend in film attendance is similar to one recorded in other Latin American countries and contrasts with trends in developed markets. In fact, Graph 2 shows that in recent years film attendance in countries such as the US and Spain has fallen. In the US, this drop equaled a loss of some 230 million spectators between 2002 and 2010. Conversely, attendance during the last decade in certain Latin American countries such as Mexico and Brazil rose significantly. Over this ten-year period the number of spectators in Mexico increased by 100 million and by 63 million in Brazil while film attendance doubled in Argentina, Colombia, Peru and Chile over the past five years.

Graphic 2:

These trends appear even more dramatic when the figures are analyzed in terms of relative population in the different countries, thus eliminating any bias due to size difference. Graph 3 shows that the fall in film attendance in developed markets such as the US and Spain is even greater in terms of relative population (attendance index) than in absolute terms. In Latin America, Brazil, Colombia and Mexico show the most remarkable growth over the past few years. In Colombia, the increase in spectators in past years affected the attendance index, doubling it over five years, with an increase from .37 spectators per capita in 2005 to .74 in 2010. In the first semester of 2011, the attendance index continued to grow and now rests at .83 spectators per capita.

Graphic 3:

What could have caused this behavior? The fall in attendance indexes in countries such as the US and Spain is due, among others, to three factors. On the one hand, the crisis affecting developed economies in recent years has undeniably curtailed consumption of many goods and services, including entertainment. Add to this the negative effects of illegal digital content on the legal industry, although the phenomenon has not reached the alarming dimensions experienced in the music industry. Finally, because of the mature nature of these markets, attendance indexes are much less likely to rise with the presence of new technologies or products, unlike in developing markets.

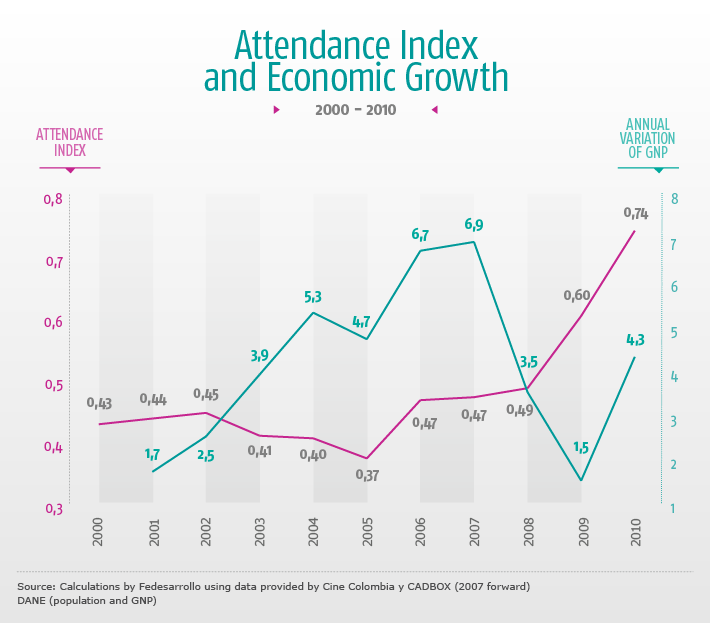

In Colombia's case, some clarification is required before analyzing the possible explanations for the recent expansion in this industry. Although the film industry has grown over the past few years throughout Latin America, along with many other businesses in emerging economies, the recent dynamism in Colombia cannot be explained by economic growth alone. In fact, Graph 4 shows that recent growth in film attendance in the country is only slightly related to economic growth.

Graphic 4:

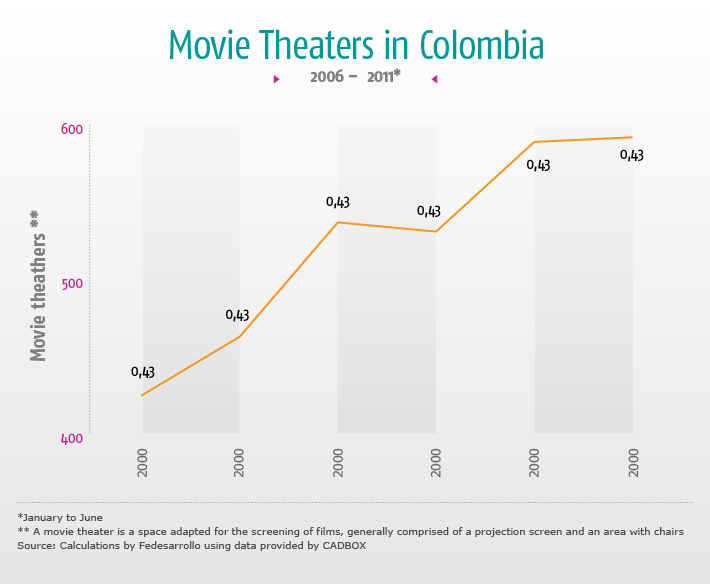

In this context, three potential causes of this marked growth in attendance indexes over the past few years can be identified. First, film attendance has reacted favorably to the renovation and expansion of theaters throughout the country. Graph 5 shows how the number of theaters went from 424 in 2006 to 591 in 2011 and spurred the rise in the theater index by one million inhabitants – from 9.8 to 12.8 over the same period.

Graphic 5:

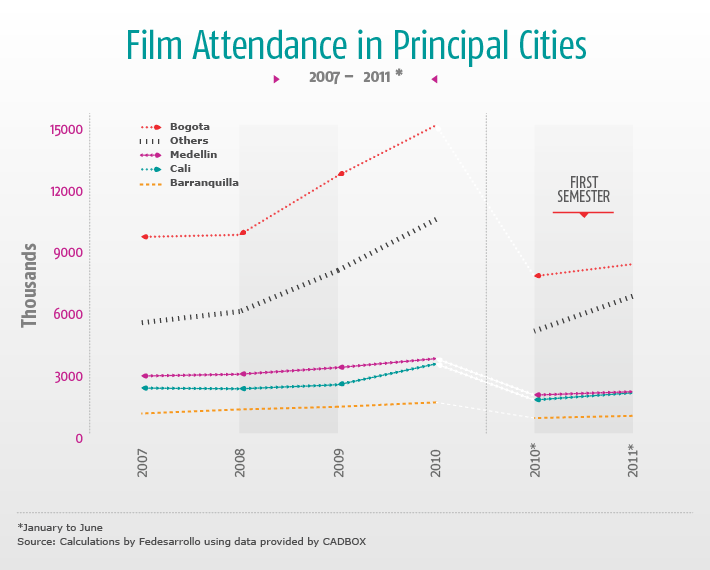

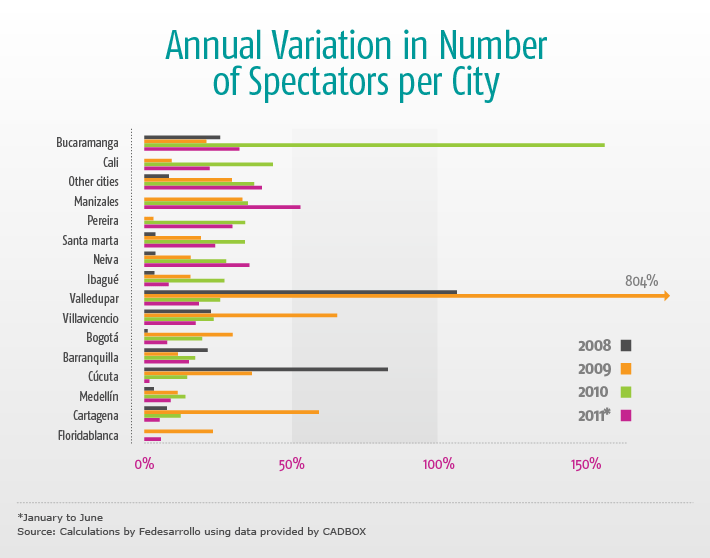

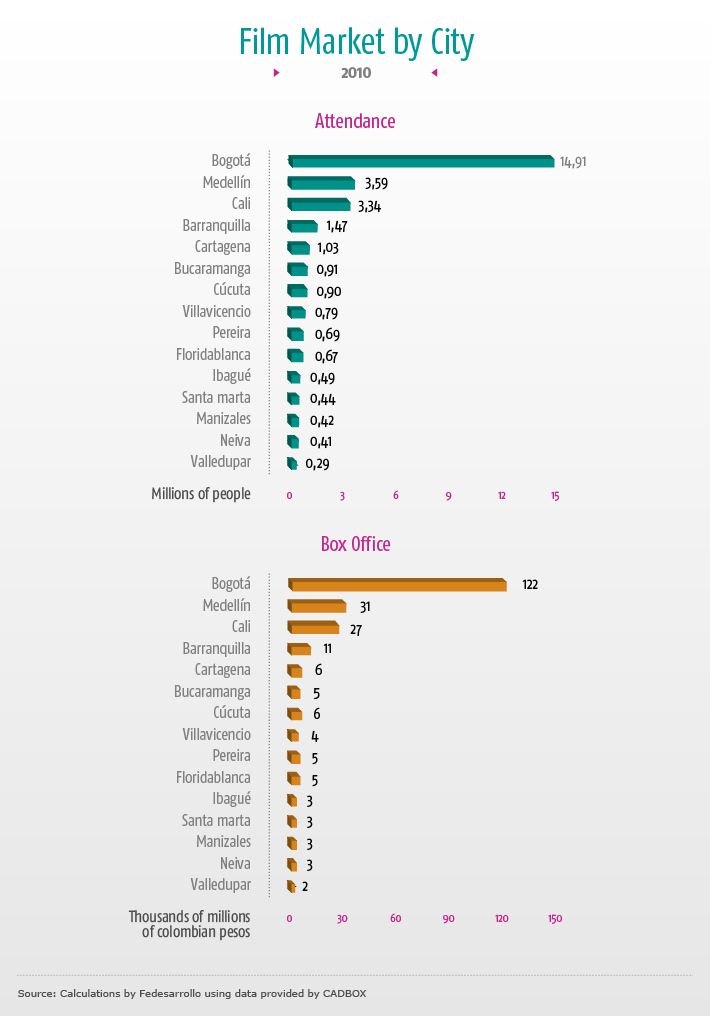

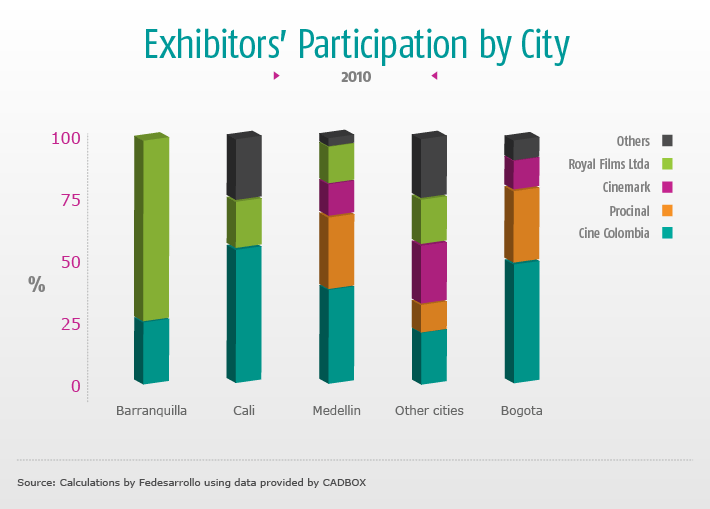

Several of these new theaters have been built in the country's intermediate cities, in neglected market niches where attendance has risen more than in some of the larger cities, except for Bogotá. Graphs 6 and 7 show that the greatest increase in attendance in recent years was in Bogotá and medium-sized and smaller cities.

Graphic 6:

Graphic 7:

Another factor favorably affecting attendance has been the innovations to the product on offer, both in projection quality and the boost in the film industry brought about by 3D technology.

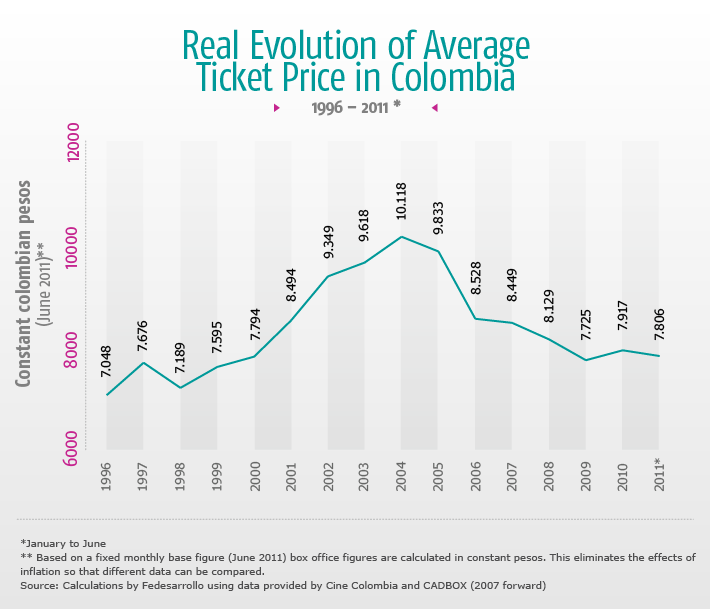

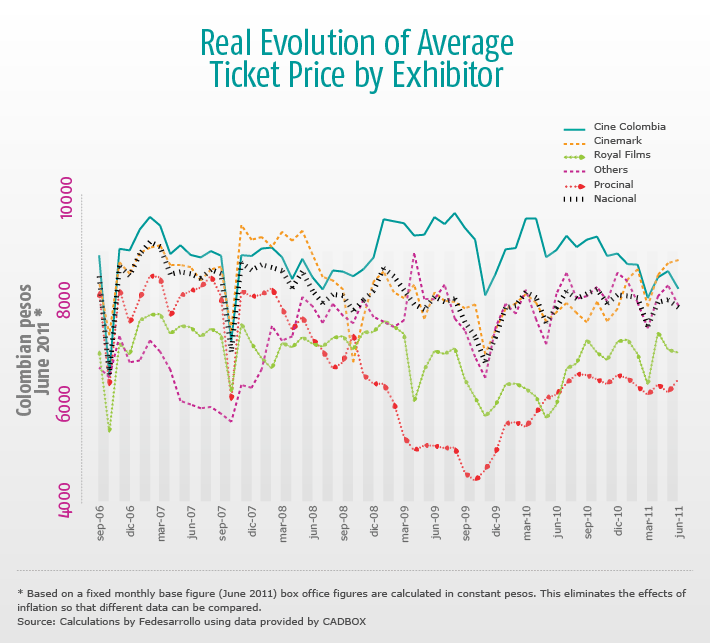

Finally, we should point out the importance of the trend in demand and its effect on ticket prices in recent years. Graph 8 shows how the average ticket price in Colombia has dropped in real terms over the past few years. From 1996 to 2004, the average ticket price rose by 14%, in real terms, from $7,048 pesos to $10,118 (constant prices based on June 2011), while starting in 2005 the average ticket price dropped in real terms by 22.9%.

Graphic 8:

The current factors such as construction of theaters in neglected markets and intermediate cities, as well as the expansion of digital screenings and 3D projections can reasonably be foreseen to continue in the near future. Likewise, exhibitors can be expected to maintain a policy of rational ticket prices, especially in light of the positive response in attendance to reduced prices. Based on the preceding, the film business in Colombia should continue to grow over the next few years, perhaps even at a faster pace than the Latin American average, until the country achieves attendance indexes close to those in the region's stronger markets.

|

|

|