SECOND COLOMBIAN FILM INDUSTRY BULLETIN

A project designed by Fedesarrollo for Proimágenes

Download the full special report on excel.

SPECIAL REPORT

The expanding film market in intermediate and small cities

Undoubtedly, the Colombian film market is experiencing a marked boom. 13% growth in spectator attendance is proof, with an increase in attendance in four of the countries major cities: Bogotá, Medellin, Cali and Barranquilla. In 2011, attendance in intermediate and small cities grew by 21.4%. (Intermediate cities are those with a population between 400,001 and 1,200,000 inhabitants, while small cities are those with a population 400,000 or fewer inhabitants.) This special report analyzes the growth experienced in these cities.

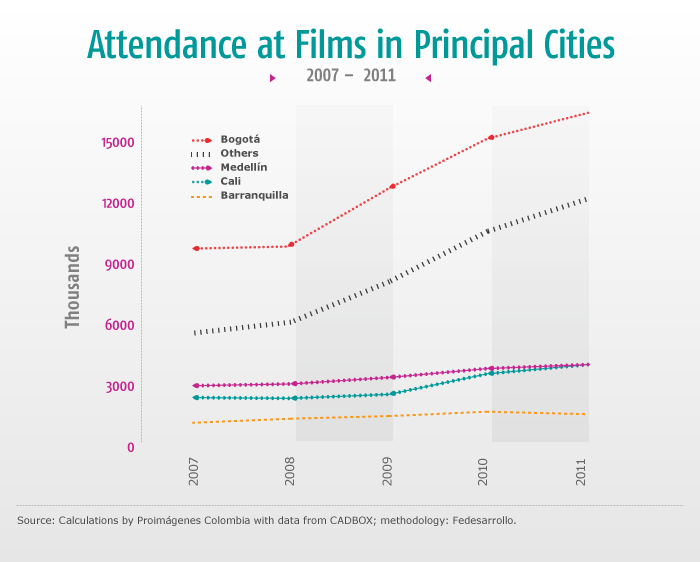

In 2011, attendance in four major cities increased an average of 10.36% and by 17.50% in the rest of the country ("Resto", or 38 "Other" cities throughout the country with movie theaters). As illustrated in Graph 1, the most marked increase in film attendance from 2010 to 2011 took place in Bogotá and "Resto" ("Others").

Graph 1. Film Attendance in Major Cities

The number of spectators in Medellin and Cali has been relatively comparable, although until 2010 numbers for Cali fell below those for Medellin. However, in 2011 Cali surpassed Medellin possibly due to a number of factors including an increase in ticket prices in Medellin and newly constructed theaters in Cali serving an audience which had previously been denied this access. In 2011, Cali recorded 3,825,337 spectators while in Medellin attendance figures totaled 3,816,458, even more impressive when we consider Cali's population of 2,294,653 compared to 2,393,011 inhabitants in Medellin.

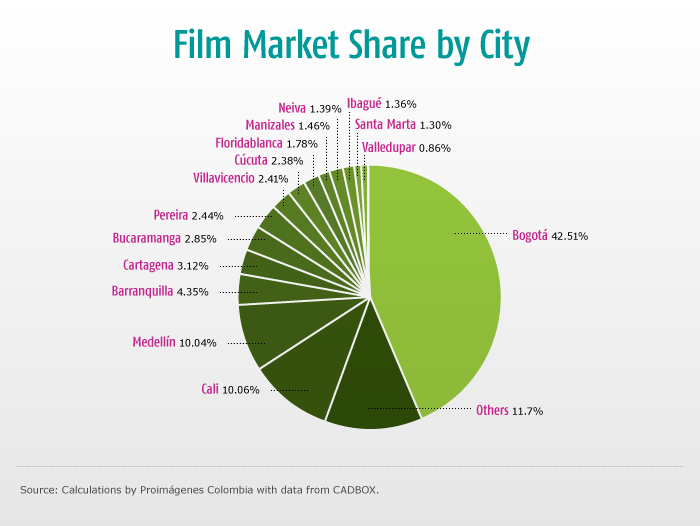

Graph 2. Film Market Share by City

* In Graphs 2 and 3, "Resto" ("Others") includes 27 cities not listed individually.

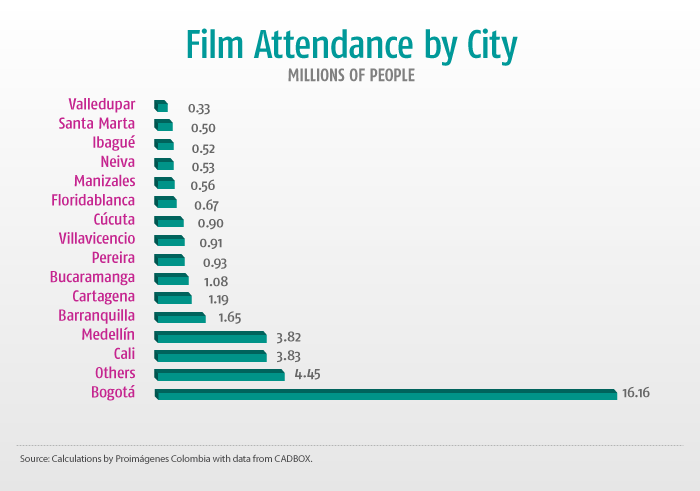

Graph 2 illustrates Bogota's predominance in the national market due to its larger population, per capita income and level of urbanization. A total of 16.16 million spectators attended in 2011, for a total market share of 42.51% of the country's total attendance, nearly four times that of Cali, the city with the second highest attendance.

Graph 3. Film Attendance in Colombia by City

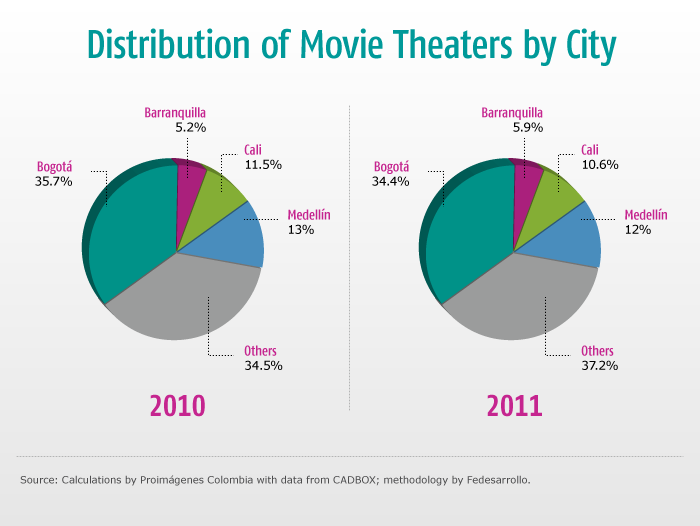

Graph 4 shows a slight growth of 2.7% in the market share for intermediate and small cities ("Resto" or 38 "Other" cities with movie theaters, other than the four major cities) between 2010 and 2011. Last year, "Resto" ("Others") was responsible for 37.2%, with a share even greater than that of Bogotá.

Graph 4. Market Share by City

* "Resto" or "Others" includes 38 cities with movie theaters, other than the four major cities

Increase in Number of Screens

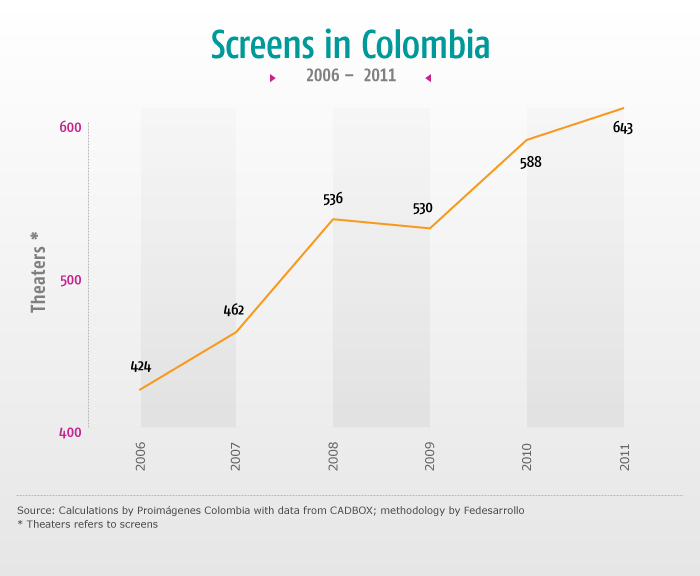

The rise in film attendance in intermediate cities is linked to an increase in the number of exhibition screens in these cities. Graph 5 indicates that 55 new screens began operating in the country in 2011. The total number of screens rose to 643, including 191 digital screens. 70% of these new screens operate in intermediate and small cities.

Graph 5. Exhibition Screens Colombia

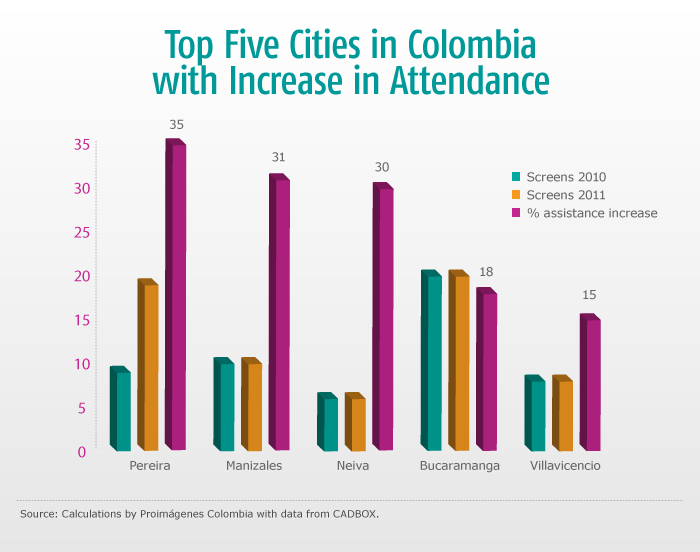

Pereira, Manizales, Neiva, Bucaramanga and Villavicencio, in that order, were the intermediate cities in Colombia with the largest increase in attendance. The effect of new screens on this attendance was evident in Pereira, where attendance increased by 35% and the number of screens doubled (Graph 6). Please note that small cities, as a group, also experienced 35% growth.

Graph 6. The Five Cities with the Greatest Increase in Attendance in Colombia in 2011

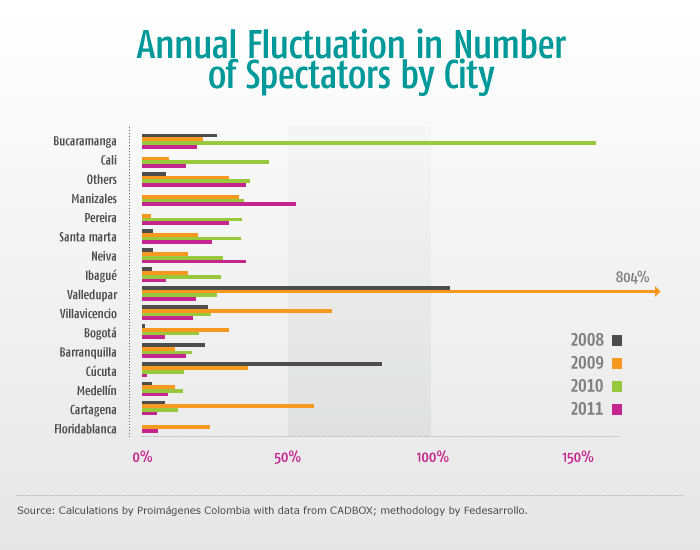

Graph 7. Variation in Number of Spectators by City

Graph 7 shows the percentage by which attendance varied in cities throughout Colombia. For example, in 2009, attendance increased by 805% in Valledupar, due possibly to an increase in the number of screens from one screen in 2008 to five in 2009. Likewise, in 2010, attendance in Bucaramanga was up by 156%, due also perhaps to an increase in the number of screens in this city from 16 in 2009 to 20 in 2010.

Lower Relative Price of Admission:

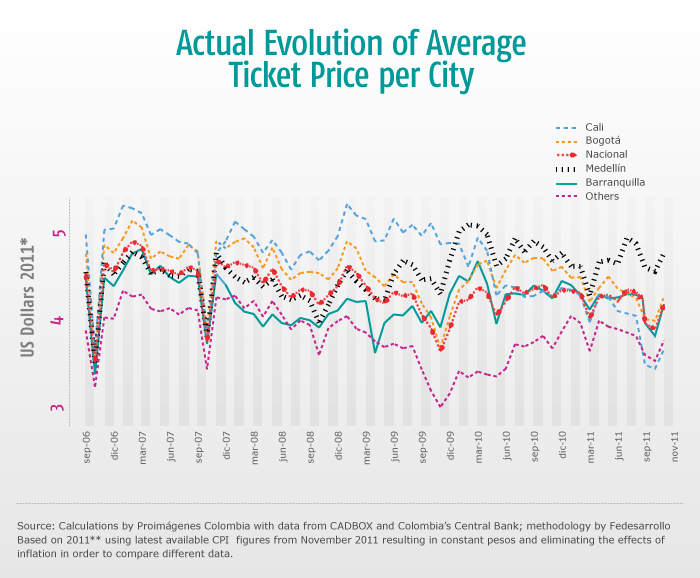

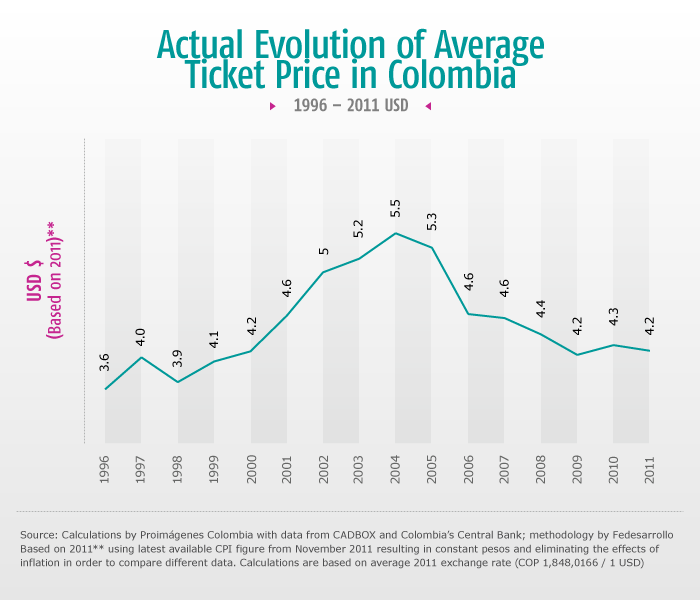

Another important factor which influenced the growth in film attendance was the lower relative cost of admission (in constant pesos). Graph 8 shows that over the past five years the average price of admission in "Resto" ("Other") cities has continually and permanently fallen below that of the national average, and therefore brought in more spectators. We also see that ticket prices in Medellin and Bogota have remained above the average. Average ticket price is 2011 was USD$4.19, with a tendency to fall since 2004. It is, in any case, important to point out that prices in 2010 were nearly the same as this year (USD$4.20).

Graph 8. Evolution of Average Price of Admission by City

Graph 9. Actual Evolution of Average Price of Admission in Colombia: 1996-2011

The rise in attendance in intermediate and small cities, brought abut by the emergence of new theaters and lower relative ticket prices, proved there was a market waiting to be served. Conditions in the sector have created opportunities for growth in the national market and represent important potential for Colombia's film market.

|